A Guide About How to Lower Refinance Closing Costs?

Oct 18, 2023 By Susan Kelly

Introduction

How to Lower Refinance Closing Costs? In our experience, many borrowers applying for their first mortgage have no idea they have the option to negotiate interest rates with their lenders. When you have a solid credit history, a large amount of home equity, and the option to choose a shorter loan term, you will have more leverage in negotiations. However, it is crucial to compare various loan providers. Show the lower rate quote to the other lenders you're considering if you get one. There's a chance that one of them will match or even beat the terms of your current mortgage offer. The best mortgage rate should be negotiated, even if you intend to accept a higher rate in exchange for loan company credits to cover closing costs.

Tips To Lower Refinance Costs

Compare Mortgage Lenders' Offerings

Competition among mortgage refinances lenders is similar to that in the retail and hospitality industries. There is no substitute for regularly comparing rates and fees from various lenders to ensure you get the best deal possible. Because the interest rates provided by many lenders won't apply to your specific situation, you should begin the application process and compare loan estimates from each lender you're considering. Don't forget to include loan fees, which can add thousands to your closing costs while comparing rates.

Negotiate A Lower Interest Rate And Lesser Fees

It's possible to change some closing charges and not others. For example, the percentage of the loan that goes toward origination fees is generally between 0.5 percent and 1.5 percent. If your loan officer charges you 1% or more in fees, you should ask for a reduction. If you have agreed to a higher loan origination price, you may be able to negotiate with your lender to waive additional fees, such as the application or processing fee.

You might also try to negotiate a lower interest rate if you have an offer from a different lender willing to go lower. Prove your interest to the other loan providers by displaying this page. It all depends on your loan type and how much room there is for negotiation. For instance, VA loans have already been subject to a cap on closing costs imposed by the Department of Veterans Affairs. There is a chance that your lender will not accept a lower offer.

Maintain Your Current Title Insurance Provider

The price of a title search and insurance could reach $1,000 or more. Ensure your current loan's title insurance is renewed by contacting the company that issued your coverage. You could potentially save money on your refinancing, thanks to this. The fee will cover the price of checking the property records to confirm ownership and identify any liens that may have been filed against your home.

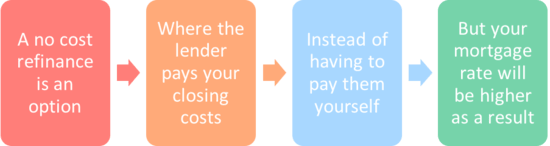

Request A Refinance With No Closing Costs

Getting a new mortgage loan will always cost a lot of money. Even though mortgage lenders may claim to offer no-closing-cost loans, you will likely end up paying for them in the form of a higher interest rate. Yet, this deal may be perfect for you if you need a little help getting started financially. In the current low-rate market, you may save money over the long term, even after factoring in closing fees into your new rate. Some lenders may additionally tack on closing costs to the new loan amount. As a result, your loan's principal will increase, necessitating a sum of equity sufficient to meet the new balance.

Verify Once More With Your Present Lender

Before you commit to a new lender, find out if your current lender is willing to provide lower rates and fees. Competition is high because mortgage rates are so low. There's a chance that your existing mortgage lender will compete with other institutions by providing you with a lower interest rate.

Think About A Simplified Refinancing Plan

Simplified refinancing can help you lock in the lowest possible interest rate on your mortgage. Nothing like this can be done with a regular loan. Talk to your current lender about a streamlined refinance if you have a government-backed mortgage (FHA, USDA, or VA). Neither a credit check nor an appraisal of your new home will be necessary. This will help you save money on your closing costs. Cash-out and streamlined refinancing are unavailable, as they can only be used for the same loan type. An FHA streamlining cannot be used with a VA loan and vice versa.

Start By Improving Your Credit

If you want to refinance and cut costs, improving your credit can be the way to do it. Refinancing mortgage rates are more affordable the higher a person's credit score. By keeping up with mortgage payments, homeowners who refinance may boost their credit scores. A higher credit score could improve your bargaining position, but it will have no bearing on the final cost of the loan.

Conclusion

Refinancing your mortgage at a lower interest rate will save you money, but it won't cost you anything. Closing charges are required just like they were for your first mortgage. In most cases, a borrower needs to search for the best closing costs because they will differ from lender to lender. You can also reduce your refinancing costs by asking for discounts and discovering what kind of rewards your loyalty earns you.